You’ve toyed with the idea of getting yourself a financial planner in the past but have been reluctant to fork out thousands of dollars without knowing what you’re getting yourself into. After all, you wouldn’t buy a car without a test drive.

You’ve toyed with the idea of getting yourself a financial planner in the past but have been reluctant to fork out thousands of dollars without knowing what you’re getting yourself into. After all, you wouldn’t buy a car without a test drive.

So you decide to try the DIY option first, and take a quick look around the website of your superannuation provider to see if you can figure out what to do with that little nest egg growing in your everyday bank account and earning interest of less than one per cent.

Then you scan the websites of some other wealth managers, and you think: “Why do I even need a financial planner? I can do this myself.”

So you read on, and it’s not too long before you feel bamboozled by all the jargon. There’s talk of bond markets and share markets – and you realise this is nothing like walking down the aisles of your local supermarket where you can quickly sample a grape before committing to a bunch. It looks like you need to know a lot about investing before you even start, and there’s no try-before-you-buy option.

The first big problem you encounter is that these so-called experts in the industry ask the reader “What sort of investor are you”, or they demand that you identify your investor profile. And you think “How would I know? That’s why I’m here”. You wonder if this is their way of excusing themselves from losing your money in future because, hey, you made the choice to put your money in that tanking fund based on your investor profile.

But, regardless, you keep plugging away. The investor profile styles brandied about could be variations of cautious, risk-averse, conservative, active, defensive, passive, balanced, optimistic or even aggressive. Some of these “experts” even try to help you work out which bucket you fall into. Then there’s that 500-word disclaimer at the end that makes you lose all confidence.

It all looks so hard that you opt for the highest interest rate on offer for a high-yielding bank account. Do you see what you’ve done? You’ve gone from trying to find out what suits you as an investor straight to choosing a solution. It’s like deciding you need a new car and selecting the first red one you see because that’s your favourite colour. Never mind that it’s a two-seater and you have a family of four, or that it’s manual and you’ve only ever driven an automatic.

So you decide that your investor profile is best summed up as “confused” and stick to choosing a bank account. Which may not be such a bad solution, but it still leaves you wondering if there is something better you could do with your money. The short answer is that yes, you probably can.

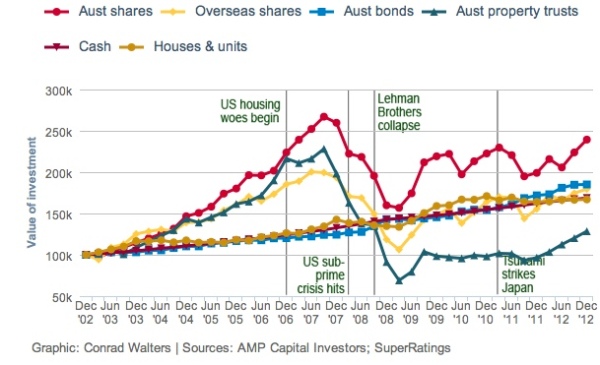

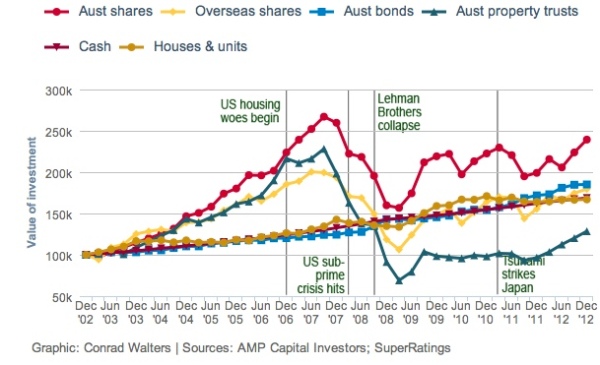

But how much better? Take a look at this chart for how various investment types would have performed to the end of December 2012 if you’d been lucky enough to have a spare $100,000 sitting around about 10 years ago.

If you’d invested in cash you would now have close to $170,000. Not bad, you’re thinking. The chances are that the value of your home would be have performed similarly (for every $100,000 in value). Even the worst performing investment in this chart, Australian property trusts, would have netted you close to $130,000 over the same time.

Interestingly, with all the talk in the media the past few years about Australian shares tanking – and they did after the US sub-prime crisis hit in 2008 – they are again forging ahead after a dismal couple of years and, generally, were the best-performing investment over this same 10-year period.

Of course, you’ve probably heard that past performance is not an indicator or future performance and blah blah blah. But there’s truth in this, which makes it a bit of a gamble trying to predict what will happen in the next 10 years.

Let’s be clear, I’m not trying to tell you where to invest your money, just that it’s worth learning a little more about each of these investment types before taking the plunge. The reality is that you’re probably already invested in most of these investments through your superannuation anyway.

Look at it this way: when you’re on the lookout for a new car you may not realise you want remote keyless entry or even a shoe compartment until you know it’s out there. In the same way, it doesn’t really help to answer questions about your investor profile while you are in the dark about the options available to you.

Once you understand a little more about how investments work and how they perform in different economic climates, you’ll be in a better position to define the sort of investor you really are. Until then, you may be wise to simply stay in that high-yielding cash account. Or take the plunge and outsource your investment decisions to a financial planner.

But why not try investing in your own financial education first? You may find that you can choose your own investments and still sleep soundly at night.