Medical advancements may be leading to longer life expectancies, but how are your retirement savings keeping up?

Medical advancements may be leading to longer life expectancies, but how are your retirement savings keeping up?

Australians are expected to live longer than most other people in the world. The United Nations in 2010 ranked Australia in fourth place for life expectancy around the world. Males are expected to make it to 79 years, and females to nearly 84. Mildly ahead of Australia are only Japan, Switzerland and Hong Kong.

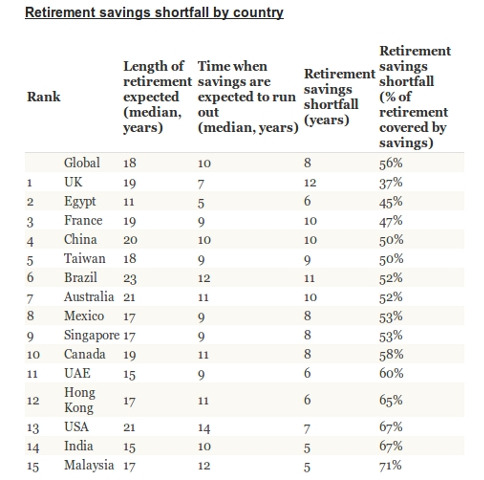

A study from HSBC in February this year shows that our retirement savings are not keeping up. On average, it found that people around the world have a 44% shortfall in their retirement savings. Australia is ranked seventh in terms of shortfall, with retirement expected to last for 21 years but retirement savings only for 10.

Worldwide, the study found that people will generally run out of retirement savings just over half way into their retirement. The United Kingdom has one of the largest shortfalls, with retirement expected to last for 19 years but the average person’s retirement will last for just seven, and the US is ranked thirteenth.

Source: The Telegraph, UK

In September 2012, the Financial Services Council in Australia announced a $1 trillion expected shortfall in retirement savings for Australians who live longer than life expectancy. To meet this shortfall, they are recommending the government bring forward the legislated 12% compulsory superannuation contributions, which are intended to take effect in mid-2019.

Putting it all together, Australians can expect to have a shortfall in retirement. But there are a few things you can do now to help bridge this gap.

1. Work longer, retire later

From 1 July 2017, the qualifying age for the age pension will increase from 65 years to 65 and a half years. The qualifying age will then rise by six months every two years, reaching 67 by 1 July 2023, however will remain at 65 for anyone born before July 1952.

Whether you like it or not, the government is expecting you to work longer before they will pay you a pension.

2. Eliminate your debts

Pay off your debts sooner. This includes credit cards, personal loans, car loans and even your mortgage. The less you have going out to pay these debts, the more you have as disposable income and more you can save.

3. Live frugally

Learning to live on less now will make the transition easier when it comes time to officially retire. Do you really need another pair of jeans to add to the pile of 10 already in your wardrobe? And rather than eating out at fancy restaurants twice a week, learn to cook gourmet meals and only eat out only once a week. There are many things you can do now to reduce your outgoings.

4. Develop new skills

According to HSBC, Australians can expect to spend 21 years in retirement. You may find that there are only so many rounds of golf you can do in this time so you may need to find other interests to occupy your time, and keep your body and mind active. Why not develop some new skills that could bring in extra cash or boost your enthusiasm for life? It’s never too late to study a new interest or take up a new hobby. You may even be able to generate an income from it.

5. Save more

Increase your contributions to super and savings as early as you can to get the benefits of compounding. Decide on a regular amount and have it deducted automatically from your pay or bank account before you get the temptation to spend it. You won’t miss it if you don’t see it in the first place.